The Fund Manager's Guide to FX-as-a-Service

A common theme in private capital right now is fund managers seeking out opportunities to outsource non-core activities as they build for scale.

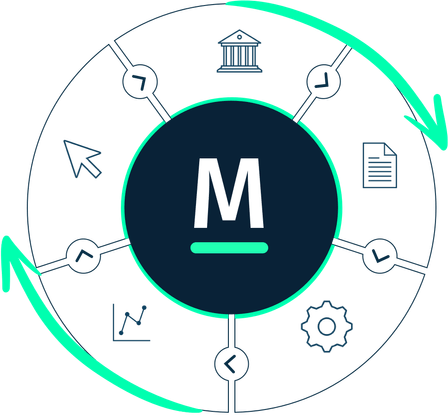

Our FXaaS is an automated FX workflow solution where Investment Managers can instruct trades and oversee their hedging programs, while all operational functions can be outsourced, including hedging calculation, execution management, settlement, and trade reporting.

We are your agent,

not your counterparty.

Trades are executed in an Agency capacity with up to 15 Tier 1 banks.

We connect directly into the firms PMS and Fund Admin for straight-through trade and regulatory reporting.

We integrate directly into the fund Custodian to auto-instruct FX settlement and payments.

Third-party TCA reports provide an independent audit of FX costs.

Instruct and adjust trades and oversee your hedging programs.

Do you know what the most common hidden FX costs are? The Forex market is one of the most opaque in the world, and with our latest FX research report for fund managers, we are lifting the hood on some of the biggest issues in the market, offering a unique window into fund manager’s views on FX and how they’re adapting their FX risk management practices & priorities.

Our Head of Institutional Solutions, Joe McKenna, highlights some of the costs associated with FX execution and hedging that fund managers should be aware of and rank them in order of transparency. His complete Fund Manager blog series can be found on the MillTechFX blog.

A common theme in private capital right now is fund managers seeking out opportunities to outsource non-core activities as they build for scale.

Access to competitive pricing and operational efficiency will always be critical factors for private equity firms when it comes to trading currencies...

Under MiFID II, fund managers that hedge their exposure to foreign exchange (FX) risk frequently have a fiduciary duty to demonstrate FX best execution.

Simply fill in both fields below and one of our friendly experts will be in touch shortly to discuss your requirements.